In 2024, the war with russia will not allow for a "big leap" in the Ukrainian economy. Experts predict very moderate growth, but still growth, not a decline. However, ensuring this growth remains a challenge.

Expert consensus

Analysts from the International Monetary Fund (IMF), the European Commission (EC), the National Bank (NBU) of Ukraine, as well as investment companies, concur in their opinion that the country's Gross Domestic Product (GDP) will grow by approximately 4% in 2024.

The IMF representatives are the most cautious in their forecasts, projecting 3.2%. The EC is more optimistic with a 3.7% estimation. Even the NBU believes the figure will be slightly lower at 3.6%.

Finally, the government holds the highest expectations. In late October, Prime Minister Denys Shmyhal stated at an economic forum in Berlin that there are conditions for "cautious optimism" next year. "Therefore, in the budget for 2024, we include a forecast for economic growth of 5%", - he explained.

It's worth noting that in the end, President Volodymyr Zelensky signed the law on the 2024 state budget, anticipating a GDP growth of 4.6%. Slightly less than the initial Cabinet forecasts, but still the boldest expectations.

The investment company Dragon Capital believes that Ukraine's economy will grow by 4% next year. However, initially, they predicted 8%, assuming that the full-scale war in 2024 would conclude.

But by the end of October, Dragon Capital revised its forecast. "Considering the dynamics on the front, we are revising our key assumption for 2024, expecting that the war will likely continue throughout the next year", - the statement said.

The continuation of the war means that "Ukraine's economy will not receive a boost from the partial return of refugees and the improvement of business and consumer sentiments", explain analysts from the investment company.

Earlier, OstroV noted that the mass exodus of Ukrainians abroad has become a serious problem for the economy. The European Commission also considers it an obstacle to faster GDP growth in 2024.

"The still significant number of displaced persons remains a risk factor for the labor market and leads to a shortage of labor in certain sectors of the economy and regions of the country", - the EC commented on its forecast.

Among the reasons for the government's reduction of the GDP growth forecast from 5% to 4.6%, "migration processes" are also mentioned.

The National Bank of Ukraine adds that in 2024, "high security risks (associated with the continuation of a full-scale war – ed.) will limit investments".

However, the NBU expects that in 2025, security risks will decrease. In other words, at least the war will cease to be full-scale, accompanied by a "gradual return of migrants from abroad, an improvement in consumer and investment sentiments, optimization of logistics and production, and the restoration of damaged infrastructure". According to NBU estimates, this could lead to an acceleration of GDP growth to 6% in 2025.

Similarly, experts unanimously agree that consumer inflation (the rate of price growth for goods and services for the population) in 2024 will continue to slow down. The IMF believes it will be around 13%, compared to the forecasted 17.7% in 2023.

The EC expects an even greater slowdown, down to 11%, while Dragon Capital anticipates 8%. The state budget law for 2024 signed by the president is based on a forecast of 9.7%.

So, the economic recovery next year will be quite modest, considering what it could have been. This is primarily due to the ongoing war.

However, the immediate "brake" for growth is not the war itself but the shortage of labor resources it has created. This is the common denominator in the forecasts of the IMF, EC, NBU, Cabinet, and investment companies.

Incentives and challenges

Now, about the incentives for growth. That is, the factors that will push the economy upwards. According to the National Bank, this includes maintaining a "soft" fiscal policy. In simple terms, the NBU believes that the government will not burden citizens and businesses with new taxes or raise existing ones next year.

Another factor mentioned in the NBU's forecast is the "development of alternative delivery routes". This refers to new export routes for Ukrainian goods through western borders: towards Baltic, Romanian, Bulgarian, Greek, and Croatian ports.

It's worth noting that the search for "alternative delivery routes" became necessary due to the blockade of Ukrainian ports in the Black Sea by russian forces. As reported by OstroV, these ports were partially unblocked this year.

Therefore, Dragon Capital believes that the "recent resumption of exports through Ukrainian ports in the Black Sea could be a significant driver of economic growth" in 2024.

According to the investment company's calculations, without a full resumption of navigation, Black Sea ports will be able to export 1.5-3.5 million tons of cargo monthly. However, if the blockade is fully lifted, it will add 1% to the annual GDP growth, bringing it to 5%.

In terms of additional export revenues, this would amount to $9-10 billion, reaching $20 billion in the scenario "without Ukrainian Black Sea ports".

It's worth noting that the NBU analysts, discussing the development of alternative delivery routes, apparently did not account for the new problem that arose in November: the transport blockade on the western border initiated by Polish and Slovak freight carriers.

It seems that Dragon Capital also did not consider this factor in its export dynamics forecasts. This issue seriously impacts the opportunities for Ukrainian exporters and needs to be resolved as soon as possible.

As OstroV noted, Ukrainian farmers managed to harvest a record crop this year, making it crucial to address this issue promptly.

Therefore, according to the calculations of the Minister of Agrarian Policy, Mykola Solsky, in the current marketing year (ending on June 30, 2024), it is necessary to export at least 55 million tons of agricultural products. This is only possible with the unlocking of the western direction through Poland and Slovakia, as noted by the Ukrainian Grain Association.

It is also worth noting that in 2023, the National Bank of Ukraine (NBU) transitioned to a phased reduction of the discount rate, from 25% to 16%. This contributed to the "revival" of the economy, making loans more affordable and accessible for businesses.

In 2024, the NBU promises to continue reducing the discount rate, provided there is a "significant reduction in risks to exchange rate stability and inflation dynamics".

This depends, firstly, on uninterrupted inflows of international financial assistance and, secondly, on unimpeded exports. Both points are currently uncertain. Thus, we have to talk not only about incentives for economic growth but also about challenges that threaten to neutralize these incentives.

Another significant challenge next year is the country's massive external debt. Servicing it (repayment plus interest payments) can "consume" a lion's share of the state budget revenues.

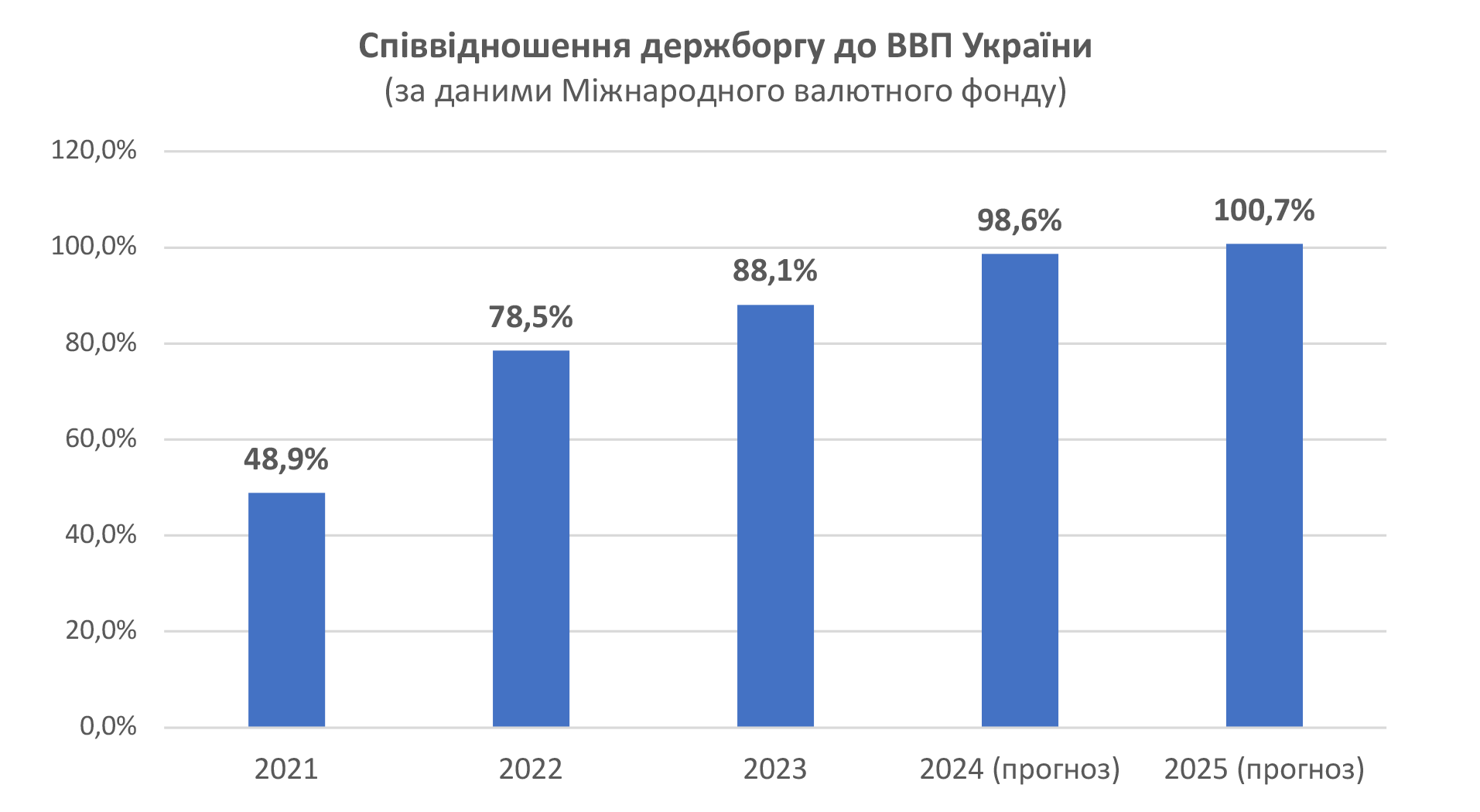

The IMF has calculated that Ukraine's external debt will soon exceed the annual volume of its economy. This is because not all foreign financial aid is non-repayable; a significant portion consists of loans that must be repaid with interest.

The ratio of national debt to GDP of Ukraine (according to the International Monetary Fund)

The government is aware of this challenge, and as early as October of this year, before the previously set deadline, representatives of the Ministry of Finance began consultations with holders of Ukrainian external debt bonds (private banks and investment funds) on the terms of a new debt restructuring.

Clearly, the government is requesting creditors for a new payment deferment and a reduction in the interest rate on bonds, citing the ongoing full-scale russian war against Ukraine.

Such negotiations typically conclude with a new agreement. The question is how favorable the new terms of debt payments will be for Ukraine.

Market positivity

Expert forecasts are based on statistical data, but they also take into account assessments from business representatives—those who see and understand the situation from within their markets.

These assessments are quite optimistic. According to a survey conducted by the European Business Association among directors and owners of large and medium-sized companies in October, 65% of such companies in Ukraine intend to increase the number of job vacancies next year.

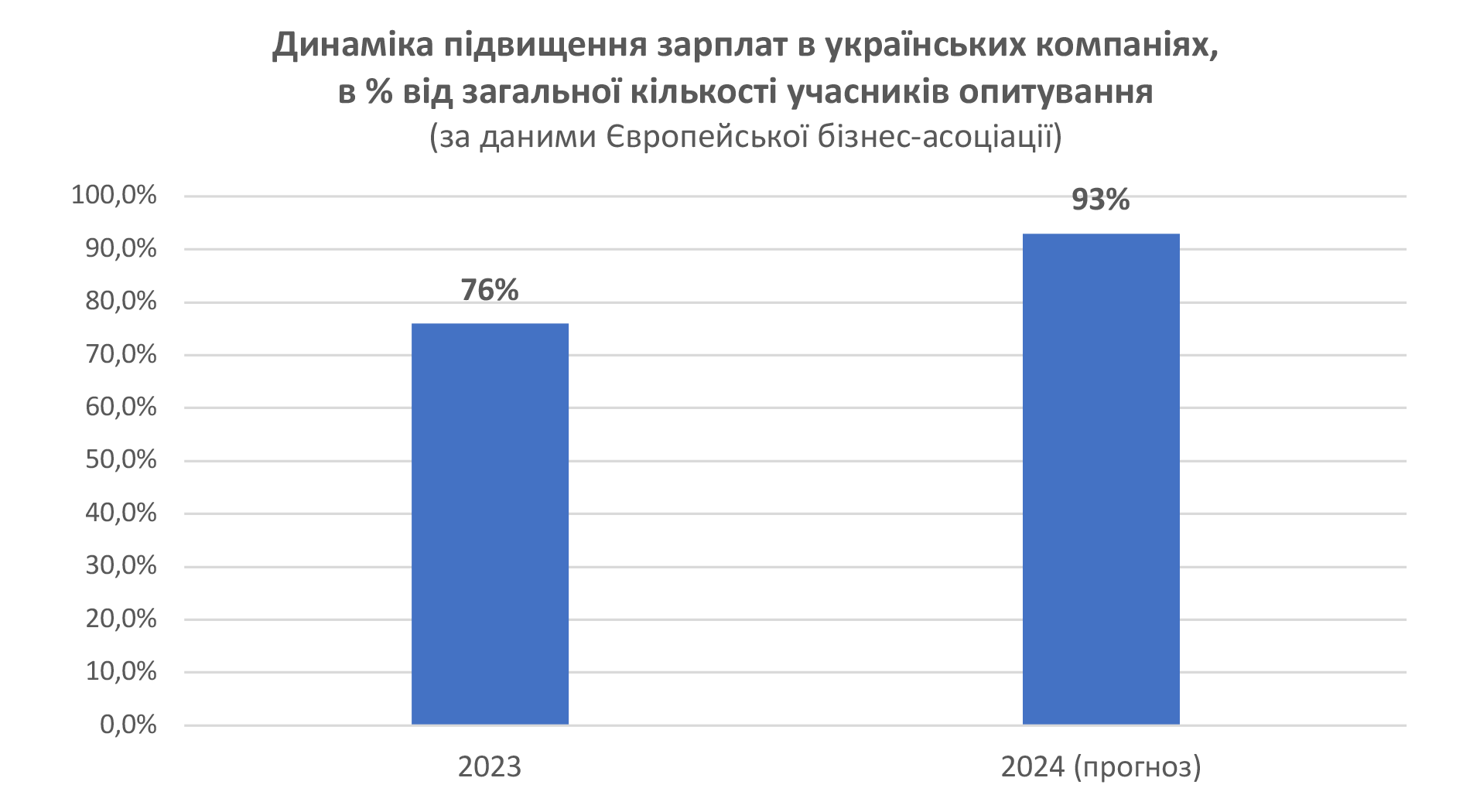

Moreover, over 80% have no plans to reduce their workforce. Furthermore, almost all of them plan to increase salaries for their employees in 2024. While salaries increased this year as well, the number of such companies doing so will be much larger next year.

The dynamics of salary increases in Ukrainian companies, in % of the total number of survey participants (according to data from the European Business Association)

Certainly, if businesses were faring poorly, no one would even consider the option of salary increases.

Finally, ordinary Ukrainians are looking optimistically towards the future. According to a survey conducted in mid-November by the Kyiv International Institute of Sociology, two-thirds of the population expect an economic upturn in the country (i.e., GDP growth of 5-7% per year or more).

However, this is not expected to happen overnight. According to 21.2%, the economic boom will begin within 1-2 years after the end of the war. Another 48.5% believe it will take more time: 3-5 years.

By Vitaliy Krymov, OstroV